Smarter Credit Decisions. Faster.

Trusted by banks, credit unions, accounting firms, and consultants worldwide, TAC CREDIT™ streamlines financial statement analysis and delivers unmatched insights for confident lending.

Why TAC CREDIT™

Lending professionals need tools that balance speed with accuracy. TAC CREDIT makes financial spreading, credit analysis, and reporting effortless, without compromising on depth or quality.

- Accuracy you can trust – Reduce errors with built-in safeguards.

- Efficiency that saves time – Spend less time on data entry, more on decision-making.

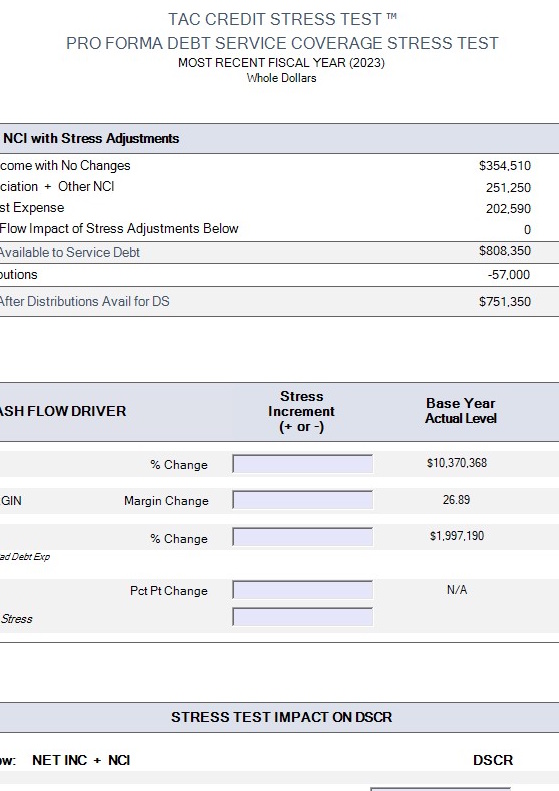

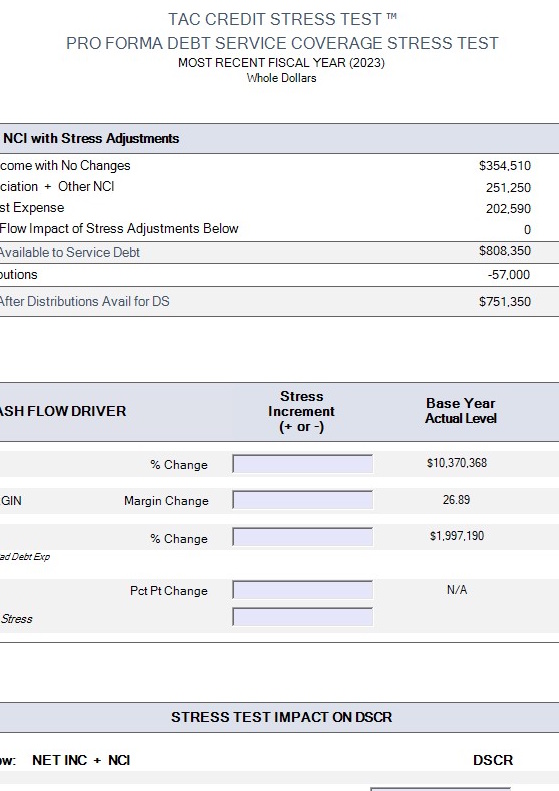

- Insights that matter – Access powerful ratio analysis, stress testing, and projections in minutes.

Key Features

at a Glance

All the tools lending professionals need — in one platform.

Cash flow & ratio analysis

Customers We Serve

Community & Regional Banking Institutions

National and International Banking Organizations

Credit Unions & Member Institutions

Accounting, CPA, and Advisory Firms

Nonprofits & Development Institutions

Specialty & Government Lenders

Spread, Analyze, Present

Software and Relationships –

We Build Both™

Our Story

Our Mission

To empower lending professionals with software that transforms complex financial analysis into clear, actionable insight.

Credit analysis software built to support confident, high-quality lending decisions.

Explore powerful features that streamline and strengthen your credit decisions.

Explore powerful features that streamline and strengthen your credit decisions.

Credit analysis software built to support confident, high-quality lending decisions.

Get in touch with questions, feedback, or to explore support for your credit analysis needs.

Smarter Credit Decisions. Faster.

Trusted by banks, credit unions, accounting firms, and consultants worldwide, TAC CREDIT™ streamlines financial statement analysis and delivers unmatched insights for confident lending.

Why TAC CREDIT™

Lending professionals need tools that balance speed with accuracy. TAC CREDIT makes financial spreading, credit analysis, and reporting effortless, without compromising on depth or quality.

- Accuracy you can trust – Reduce errors with built-in safeguards.

- Efficiency that saves time – Spend less time on data entry, more on decision-making.

- Insights that matter – Access powerful ratio analysis, stress testing, and projections in minutes.

Key Features at a Glance

All the tools lending professionals need — in one platform.

Cash flow & ratio analysis

Customers We Serve

TAC CREDIT™ supports a wide spectrum of professionals across the lending ecosystem. Whether you’re a community lender, a global bank, or a specialized advisory firm, our software adapts to your workflow and scales with your needs.

Community & Regional Banking Institutions

National and International Banking Organizations

Credit Unions & Member Institutions

Accounting, CPA, and Advisory Firms

Nonprofits & Development Institutions

Specialty & Government Lenders

Spread, Analyze, Present

Software and Relationships –

We Build Both™

Our Story

Our Mission

To empower lending professionals with software that transforms complex financial analysis into clear, actionable insight.

Credit analysis software built to support confident, high-quality lending decisions.

Explore powerful features that streamline and strengthen your credit decisions.