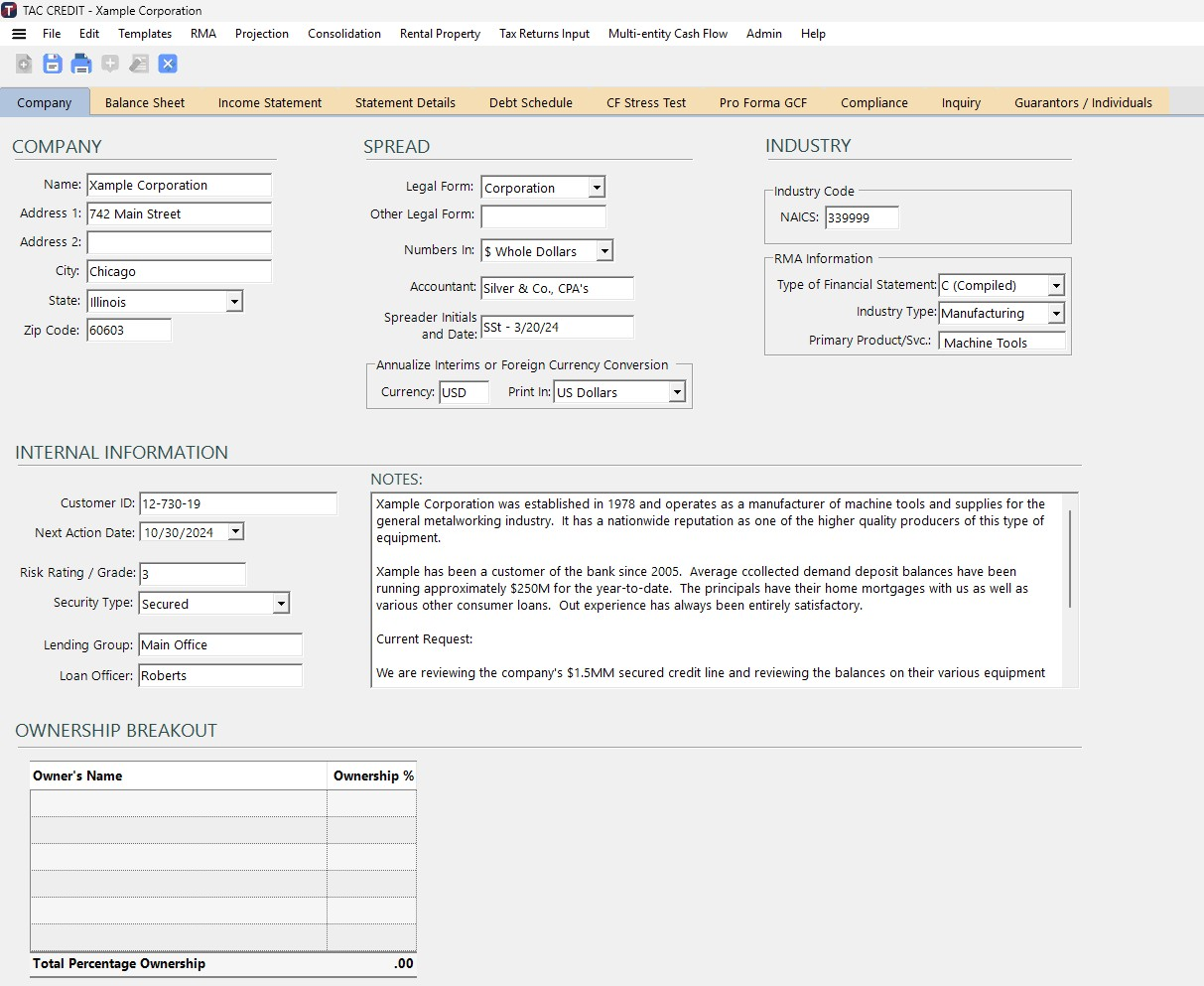

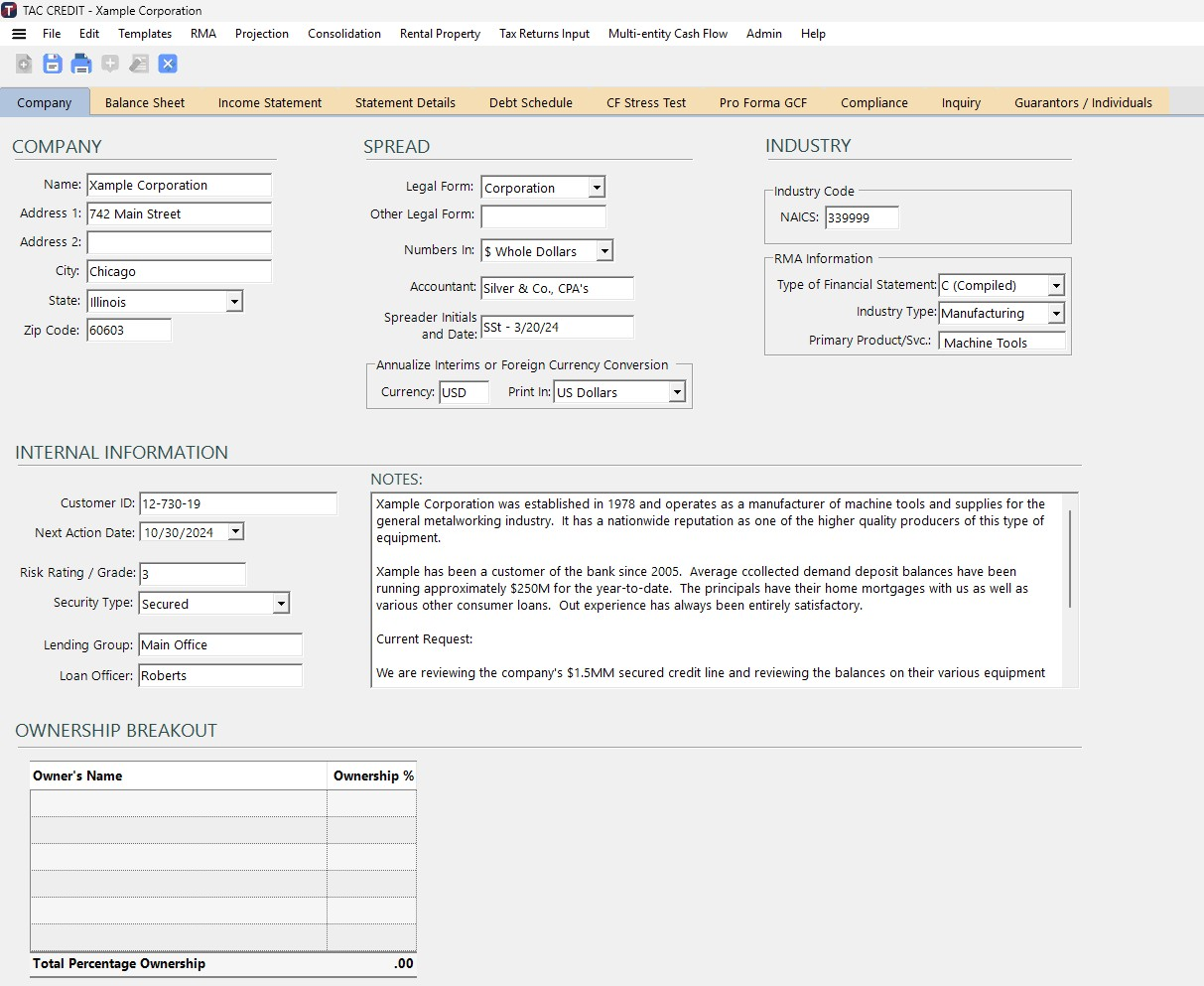

Features Built for Smarter Credit Decisions

Comprehensive Financial Analysis

Get a complete view with balance sheets, income statements, common-size comparisons, and trend charts that highlight key performance insights.

Cash Flow & Ratio Tools

Stress Testing & Risk Monitoring

Narrative & Inquiry Reports

Guarantor & Covenant Integration

Tax Form Conversion

Consolidation & Global Cash Flow

Projections & Planning

Rental Property Analysis

Your Data. Your Network. Your Control.

TAC CREDIT™ is installed directly within your environment, giving your institution complete ownership of sensitive financial data. Unlike cloud-only solutions, every report, analysis, and customer record remains securely behind your firewall and under your IT team’s control.

With flexible deployment options, from individual desktops to Citrix or Remote Desktop environments, TAC CREDIT adapts to your infrastructure without exposing information to third parties.

When it comes to credit analysis, data security isn’t optional. TAC CREDIT keeps your information exactly where it belongs: inside your network, under your safeguards, and fully protected.

Your Data. Your Network. Your Control.

TAC CREDIT™ is installed directly within your environment, giving your institution complete ownership of sensitive financial data. Unlike cloud-only solutions, every report, analysis, and customer record remains securely behind your firewall and under your IT team’s control.

With flexible deployment options, from individual desktops to Citrix or Remote Desktop environments, TAC CREDIT adapts to your infrastructure without exposing information to third parties.

When it comes to credit analysis, data security isn’t optional. TAC CREDIT keeps your information exactly where it belongs: inside your network, under your safeguards, and fully protected.

Proven Success, Trusted Results

For more than three decades, TAC CREDIT™ has been the trusted solution for lending professionals seeking clarity, consistency, and confidence in their credit analysis. From community banks to national institutions, credit unions, accounting firms, consultants, and specialty lenders, organizations rely on TAC CREDIT to streamline workflows, strengthen decisions, and safeguard data. Customers return year after year because the system delivers results they can count on — and many recommend TAC CREDIT to their peers, a testament to the trust and value it brings to the lending community.

Credit analysis software built to support confident, high-quality lending decisions.

Explore powerful features that streamline and strengthen your credit decisions.

Explore powerful features that streamline and strengthen your credit decisions.

Credit analysis software built to support confident, high-quality lending decisions.

Get in touch with questions, feedback, or to explore support for your credit analysis needs.

Features Built for Smarter Credit Decisions

Comprehensive Financial Analysis

Get a complete view with balance sheets, income statements, common-size comparisons, and trend charts that highlight key performance insights.

Cash Flow & Ratio Tools

Stress Testing & Risk Monitoring

Narrative & Inquiry Reports

Guarantor & Covenant Integration

Tax Form Conversion

Consolidation & Global Cash Flow

Projections & Planning

Rental Property Analysis

Your Data. Your Network. Your Control.

TAC CREDIT™ is installed directly within your environment, giving your institution complete ownership of sensitive financial data. Unlike cloud-only solutions, every report, analysis, and customer record remains securely behind your firewall and under your IT team’s control.

With flexible deployment options, from individual desktops to Citrix or Remote Desktop environments, TAC CREDIT adapts to your infrastructure without exposing information to third parties.

When it comes to credit analysis, data security isn’t optional. TAC CREDIT keeps your information exactly where it belongs: inside your network, under your safeguards, and fully protected.

Proven Success, Trusted Results

For more than three decades, TAC CREDIT™ has been the trusted solution for lending professionals seeking clarity, consistency, and confidence in their credit analysis. From community banks to national institutions, credit unions, accounting firms, consultants, and specialty lenders, organizations rely on TAC CREDIT to streamline workflows, strengthen decisions, and safeguard data. Customers return year after year because the system delivers results they can count on — and many recommend TAC CREDIT to their peers, a testament to the trust and value it brings to the lending community.

Credit analysis software built to support confident, high-quality lending decisions.

Explore powerful features that streamline and strengthen your credit decisions.